A high performance platform you can rely on.

Based on Microsoft.Net framework :

- Modern,Robust, Secure

- Proven infrastructure, Leverages development

- 3-Tier Architecture

- Web based clients

- Object oriented design

- Using best practises design patterns

- Single Data Base

- Multilingual

- Real time information access

Key facts

-

Operational since 1998.

-

Used in five countries across Europe.

-

Interfaces with some of the world’s top insurance aggregators.

-

Processed approximately 400,000 policies in less than 30 months.

-

Can support over 100,000 quotes per day.

Due Diligence passed

Technology

Functionality and Lines of Business

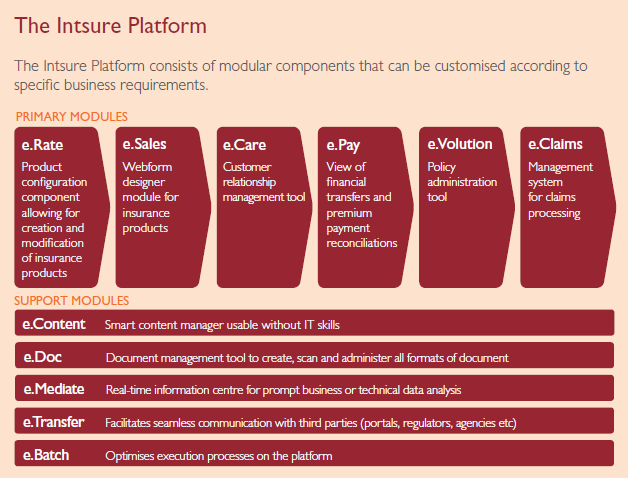

The Platform includes a number of major components. The main one is eRate, which is

the product configuration component allowing for creation and modifications of insurance products.eRate, the pricing tool of the Platform is the core engine of the rating.

It gives the user a complete, innovative way to handle pricing.

eSales is a webform generator.

eBatch is the component handling all kinds of batch processes. eTransfer is the module

managing exchange of data with external systems. eDoc is used to generate

communications and PDF mails and SMS. ePay provides a view of financial transfers and

premium payment reconciliations. Finally, eCare is a Customer Relationship Management

(CRM) tool.The Platform provides additional end-to end components.

Some only available bundled with their PAS, and others which could be licensed/installed

as standalone components.

Process/Implementation

- A short time scale : -6 month

-> Platform can be implemented within 3-6 months.

- An easy implementation

-> A white labelled Saas or other option can be proposed for an

implementation in another environment.

- Modular Technical Architecture

-> Supported language to develop the platform : C#

- Modular system

-> Modules are isolated codebase which provide particular functionality.

- Functionality

– >Platform as is seems to be ready for the next coming years according to our philosophy.Changes and adjustments will be an ongoing process

- Performance/Scalability

-> There is also a separate MIS tool developed in .Net which is role-based

Platform handled about 200,000 policies herself and Swiftcover on their clone over a million. Premium calculations/quotes went up to a million per day. Stress testing for due diligence purposes learned that a million customers could be handled easily.

They use our Platform